Calculating CLV manually can be complex and time-consuming. That’s where our online CLV calculator comes into play. Designed with simplicity and efficiency in mind, this tool enables businesses of all sizes to quickly determine the projected value of their customers.

Whether you’re a budding startup or an established enterprise, understanding your CLV is now just a few clicks away. Dive in, input your metrics, and let our calculator do the magic!

Customer Lifetime Value (CLV or LTV for “Lifetime Value”) is a prediction of the total value (typically in terms of revenue or profit) that a business can expect to derive from the entire future relationship with a customer.

Understanding CLV is crucial for businesses because it helps in determining how much they should invest in acquiring new customers and retaining existing ones.

Formula for CLV:

The basic formula for CLV is:

CLV = Average Purchase Value x Average Purchase Frequency xAverage Customer Lifespan

Let’s break down each component:

Average Purchase Value (APV):

This is the average amount a customer spends each time they make a purchase.

Formula:

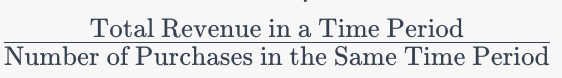

Average Purchase Frequency (APF):

This is the average number of times a customer makes a purchase in a given time period (e.g., a year).

Formula:

Average Customer Lifespan (ACL):

This is the average time a customer continues to purchase from your business before they churn (stop buying). It’s often measured in years but can be adjusted to fit different business models.

For some businesses, this might be a fixed term (like a 2-year contract for a service). For others, it might be an average based on historical data.

Multiplying these three values together gives you the CLV.

Enhanced CLV Calculation:

For a more nuanced approach, some businesses adjust the basic CLV formula by incorporating factors like:

- Discount Rate: This accounts for the time value of money, recognizing that future revenue is not as valuable as immediate revenue.

- Margin: By focusing on profit margin per customer instead of just revenue, businesses get a clearer picture of actual profitability over the customer’s lifetime.

- Retention Rate: The probability a customer will continue to do business with you in the next period (e.g., next year). This can be used to calculate a more precise lifespan or to adjust the basic CLV figure.

Using these enhanced metrics, the CLV formula can get more complex and may require statistical models, especially for larger businesses with varied customer bases. But the basic principle remains the same: to estimate the total value a customer brings to your business over the entirety of their relationship with you.